PUBLIC REVIEW of our monthly bulletin GEAB (September, 2017). Subscribe here !

Qatar, North Korea, the Baltic Sea, risk of a World War III… and all the military ranting mentioned in the media lately, are issues going hand in hand with the programmed and imminent advent of the catastrophic scenario for the dollar as a unique world reference currency: the Petro-Yuan will be in place at the end of the year. More than a petro-currency, it will be a petro-gas-gold-currency! The West is thus preparing to switch to total anachronism with this founding act of the 21st century multipolar world. 2014-2017: here we are, at the end of a three-year exacerbation period of tensions on all front lines (West against the rest of the world) and we are witnessing the up-coming end of the dollar’s reign over the world and over all financial systems and their related economic activities. Sanctions, blockades, proxy-wars, direct military threats… the question is whether the current clash of arms is really a warning sign of an Nth suicide of the West whilst hoping in vain to stop time, or whether the solution conveying power is on the verge of carrying away all possible resistance.

The magnet effect of the brand new Petro-Yuan!

The world’s biggest oil importer, China is preparing to launch gold-backed Yuan-denominated oil futures, possibly creating the most important Asian benchmark in the oil sector, allowing oil exporters to switch from US dollar-denominated assets by transactions in Yuan[1]. To make the Yuan-denominated contracts more attractive, China plans to have the Yuan fully convertible into gold on the Shanghai and Hong Kong foreign exchange markets. Last month, the Shanghai Futures Exchange and its subsidiary, the Shanghai International Energy Exchange (INE) successfully completed four production environment tests for crude oil futures; also, the exchange continues with preparatory work for crude oil futures contracts, aiming to launch operations at the end of this year. China’s Yuan asset value – coupled with the Hong Kong Stock Exchange’s plan to sell Yuan-denominated physical gold futures – will create a system helping countries to bypass the US banking system.

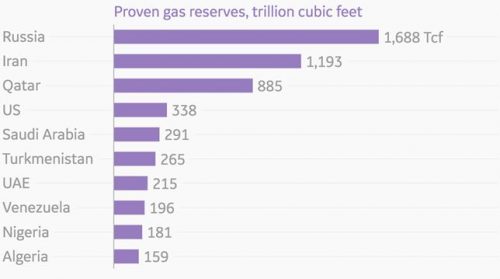

The countries which will immediately benefit from this revolution are, of course, the countries under Western sanctions, such as Russia, Iran, Venezuela… Those mentioned countries are, by the way, sitting on the world’s largest reserves of gas and oil, that is the reason why we are talking of petro-gas-Yuan, knowing that gas represents the energy of the future much more than oil does.

READ MORE

– – – – –

LEAP2040 Toutes les informations et archives Europe2040

LEAP2040 Toutes les informations et archives Europe2040