PUBLIC COMMUNIQUE of our monthly bulletin GEAB December, 2016. Subscribe here !

Since November 8, 2016, India has created a monetary revolution of a magnitude never seen, both by the size of the population concerned and the depth of the transformation induced. By demonetising the biggest notes of 500 and 1000 Rs (rupees), the Indian government is trying to reintegrate into the official economy the state’s gigantic parallel (or black or more simply the archaic) economy. In a nation where 90% of the transactions are made in cash, a huge part of the financial activity escapes the knowledge of the central government, and therefore statistics, taxes and infrastructure financing.

Blue: volume; red: value. Source: Bloomberg.

Blue: volume; red: value. Source: Bloomberg.

Warning signs

There is nothing new in the fact that the central government tries to force its population to declare their wealth. For example, between 1951 and 1997, no less than ten amnesty projects had been launched, encouraging citizens to declare their unofficial income in exchange for a simple payment of some increased tax[1].

When Narendra Modi came to power on May 26, 2014, his programme spoke of modernisation of the country according to the neoliberal principles of privatisation and deregulation. But the tone, in that respect, has changed around the world. In India, as elsewhere, investment in infrastructure, Keynesianism and taxation have become much more important than monetary easing and indebtedness. Thus, in November 2015, Modi began to put in perspective a new form of modernisation, based on a very ambitious tax reform (JAM[2]).

On June 1, 2016, he launched his own amnesty scheme, or rather his income tax declaration scheme, asking Indians to take advantage of this period to declare their unofficial liquidity imposing a tax of 45% instead of the usual 30%[3], lasting for three months.

The detail of the demonetisation process

But the operation of demonetising the 500 and 1000 Rs banknotes on November 8 (in the middle of the US election) over a period of 50 days (until December 30) was not expected. This produced a real shock, especially knowing that these notes account for 86% of the liquid circulating in India; meaning an amount of Rs 14 lakh crore (or 14 trillion rupees[4]) being withdrawn from the cash in circulation.

From 8 to 24 November it was foreseen that any person exchanging or depositing amounts of more than 250,000 rupees (Rs 2.5 lakh) without being able to justify them would pay double the normal (30%) tax on these sums, as well as a fine of 200%. During this first period of the measure, masses of notes were thus purely and simply burnt.

But on November 29 the Lok Sabha (Chamber of Representatives) judged this rule as legally unfounded and voted an amnesty decree allowing people to declare amounts above 250,000 rupees on a payment of a tax of 50%. The remaining 50% are thus reintegrated into the white economy. But that is not all, half of this laundered sum (25% of the total) is blocked in a bank account in the form of lock-ins, or bonds, for four years … at the end of which the money will be recoverable with interest (unlike the nest eggs)[5].

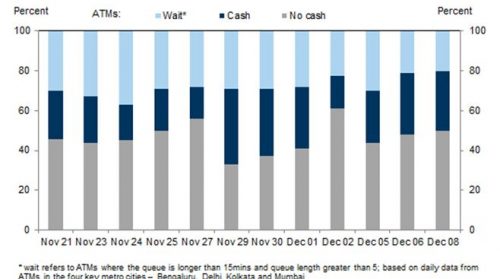

A vast chaos followed. The shocking announcement provoked a rush to the banks to exchange these notes or deposit them. In a week, the Indians had deposited 2000 billion rupees in the banks[6]. But half of the Indian population, despite numerous incentive campaigns, do not hold a bank account[7]. These 600 million people are forced to queue at the bank’s counter to exchange their notes, causing liquidity shortages, resulting in agency closures and interruptions of cash distributing machines[8].

As a result, the announcement was followed by times of panic (which seem to begin to settle down): people no longer had cash to go shopping, forcing stores to close and preventing farmers from selling their products[9]. Consumption literally collapsed and the poorest (especially in rural areas) have been hit the hardest[10]. The financiers of the world anticipate less growth and GDP points. Currently expanding to more than 7%, Goldman Sachs announces 6.8% in the next quarter, Deutsche Bank, 6.5%, and Ambit mocks everyone by evoking 3.5%[11].

The opposition to the nationalist Modi is unleashed. Rahul Gandhi threatens to make revelations in Parliament about a corruption case involving the Prime Minister[12]. The former prime minister and architect of the economic reform, Manmohan Singh, speaks of “monumental management mistakes“, and “a case of organised loot and legalised plunder” and a risk of losing 2 points of growth[13].

Cash machine situation in India. By days in 2016, light blue = line of more than 15 minutes; grey = no more available notes. Source : ZeroHedge.

Cash machine situation in India. By days in 2016, light blue = line of more than 15 minutes; grey = no more available notes. Source : ZeroHedge.

States are complaining of shortfalls in their budgets resulting from the temporary economic halt and are taking advantage of it to block the major tax reform plan to bring India into the 21st century: the Goods and Services Tax (GST[14]).

The Indian super tanker sways hard, but everyone is aware that such a measure can not be applied to a nation of 1.2 billion individuals without causing an uproar.

But what if it worked?

There have already been demonetising actions of this kind, many of which were total failures. Particularly: the Nigerian case (1984, failed); Ghana (1982, failed: people turned to foreign currencies and physical assets); Myanmar (1987, failed: it led to riots and repressions); Zaire (1990, failed: it caused inflation and a collapse of the local currency against the dollar); North Korea (2010, failed: combined with a poor harvest it lead to food shortages); Soviet Union (1991, failed: it caused a loss of confidence and the eviction of Gorbachev) [15].

What are the elements which lead our team to anticipate a success of the Indian operation? … (Read the entire report in the GEAB 110)

————————————————-

[1] Source: Economic Times of India, 10/03/2016.

[2] Jan Dhan: Bank Accounts; Aadhar : Personal identification; Mobile: mobile phones. Source: Zeenews, 06/11/2015.

[3] Source: The Indian Express, 21/07/2016.

[4] This is the occasion to get used to Indian notes. Indians do not like zero, even if they invented it, and speak in rupees (Rs, the base unit), in Rs Lakh (meaning 100 000 rupees) and Rs Crore (meaning 10 000 000 rupees). Currently the 500 rupees notes correspond to 7 € and 1000 rupees to 14 €.

[5] For a better understanding, read this article. Source: BeMoneyAware, 28/11/2016.

[6] Source: India Times, 13/11/2016.

[7] Source: The Indian Express, 10/11/2016.

[8] Source: The Wire, 11/11/2016.

[9] For example, Kerala. Source: OnManorama, 13/11/2016.

[10] Source: The Wire, 13/11/2016.

[11] Source: Quartz India, 06/12/2016.

[12] Source: NDTV, 15/12/2016.

[13] Source: The Indian Express, 24/11/2016.

[14] Source: Business Standard, 08/12/2016.

[15] Source: The Economic Times of India, 16/11/2016.

Donald Trump’s victory in the US presidential election creates the conditions for change, but it is not change yet, contrary to what the media and populists believe.

Far from being a “revolution”, the Trump’s advent at the head of the Western system corresponds to a radicalisation of the ex-ante situation. In reality, Trump is the symptom of a Western system which has failed to adapt[1] and is now trying to rule through pure violent rhetoric, by targeting citizens and nations who propose politico-economic counter-models. The method will therefore change, but the objectives and the main principles will not.

Among all the uncertainties that remain, we must now understand the subsequent challenges that threaten the rest of the world; especially the Euro zone. Technically, new opportunities for a greater European independence are now to be seized, but will we be able to seize them?

The rise or fall of the dollar: The interest rate paradox

Visibly, the euro did not manage to play its role as an international reference currency. On the contrary, it could only serve as a crutch for the US dollar. Hence, to clearly anticipate the future of the Euro, one must first understand the future of the dollar.

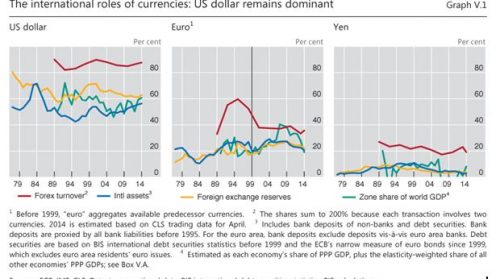

Figure 1 – The international weight of currencies: the US dollar, the euro and the yen, 1979-2014. Source: BIS.

Whilst everyone predicted a collapse of the stock market and of the US dollar with a Trump victory, this did not happen. Quite the contrary, markets are on the rise. This is because the programme of the newly elected leader, as unclear as it is, requires a heap of new debt[2]. A debt which calls for some investments, perfectly recyclable in the financial markets. Even a new cycle of quantitative easing or an equivalent might occur; and by the way, we know how profitable that is to the American stock markets.

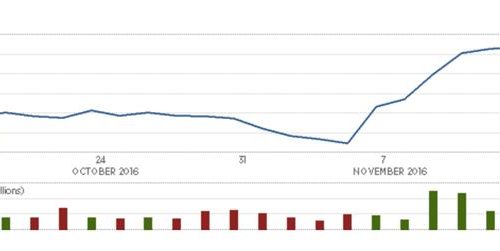

Figure 2 – The evolution of the Dow Jones over a month; the rise, starting with the election. Source: CNBC.

The same logic has increased the US bonds’ interest rate rise, in anticipation of the abundant debt supply which will struggle to find a home; and inflation will undoubtedly be triggered by the implementation of protectionist measures. Thus, the rates’ increase creates a call for money in the United States, as it becomes more profitable, and increases the value of the dollar by the increased demand.

Then, will the underdog US dollar become strengthened? Is that truly compatible with Trump’s policy? Not really. With more and more protectionist barriers, trade between the United States and the rest of the world will mechanically fail, resulting in less international use of the dollar and thus a weaker US currency. The impact of expected inflation due to rising import prices is much less clear: it all depends now on interest rates which will at least have to offset the expected inflation to attract investors. But these rates have no longer been left in the hands of the free market (since at least 2009) particularly because of Fed’s operations. On the other hand, to be able to maintain the capacity to export, despite the protectionist measures soon to be imposed on them by their trading partners, the US will need a weak dollar.

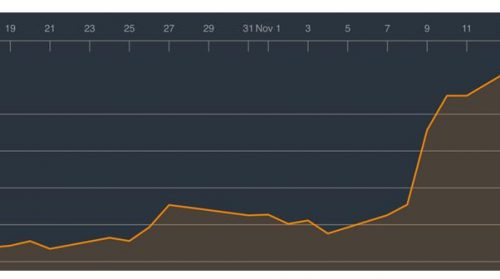

But does it really have a choice? The interest rate on sovereign bonds is the wall against which Trump’s contradictory motives will clash (Keynesian stimulus without raising debt and with lowering taxes). This rate is indeed the most revealing point of the investors’ true feelings: will the United States still be able to borrow? And for how long? A brief, simplistic calculation is enlightening[3]: in 2015, the Federal government paid $223 billion of debt interest; an increase in borrowing rate by only 1 percentage point on a debt of $19.8 trillion would double those expenses. To pay them, it would then be necessary to increase the Federal budget by more than 5% (which in 2015 amounted to $3,700 billion), and not to diminish it – as Trump would want; this is without even counting the infrastructure renovation plans he also has. It is so dangerous and unrealistic that in just one week, since the announcement of the results of the election, the 10-year bond rate has already increased by 0.4 percentage points.

Figure 3 – 10 year maturity US bonds interest, October-November 2016. Source: Bloomberg.

Keeping this in mind, and not mentioning the shock of rising interest rates for US businesses and households doped with easy money, there are only three possible options:

– cutting off expenditures other than debt repayment, especially military or social spending, a difficult and unlikely option given the political stakes and the amounts involved;

– ask the Fed to buy back the bonds via a new round of quantitative easing operation;

– defaulting on the debt, which is not an option to exclude with Trump as president… (Read more in the GEAB no 109)

—————————————————————

[1] All attempts to regulate and reorganise the eco-financial Western system since 2008 were blocked in 2010. The Frank-Dodd Act and the attacks directed mostly from the Republicans provide the most representative illustration of the failure of the reforming process following the Lehman Brothers affair. Source : LA Times, 13/01/2015

[2] Source: Fortune, 11/11/2016

[3] Source: Wikipedia.

LEAP2040 Toutes les informations et archives Europe2040

LEAP2040 Toutes les informations et archives Europe2040